Omaha Trust Lawyers

Experienced Estate Planning & Probate Attorneys in Eastern Nebraska

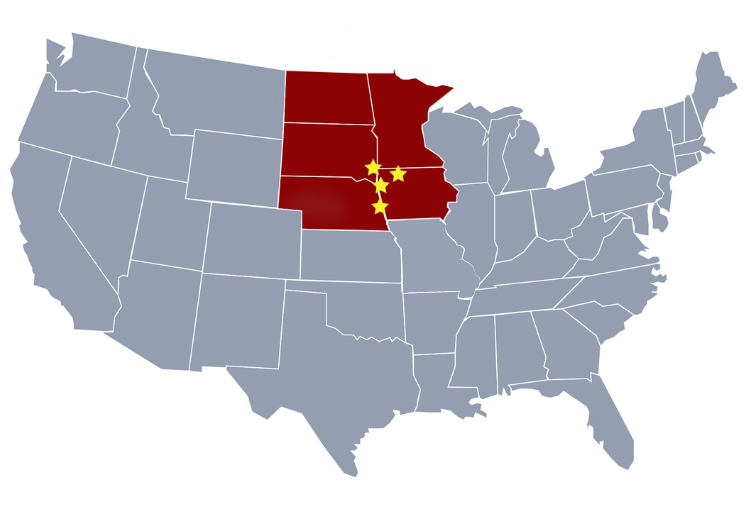

Our Goosmann Team offers comprehensive and personalized estate planning, asset protection, business succession planning, business formation, probate and trust administration, charitable planning, and estate litigation services in Iowa, Nebraska, South Dakota, North Dakota, Minnesota, and Missouri.

We also leverage our national network to provide services nationwide based on our Midwest roots. We are privileged to work with many individuals, families, professionals, and business leaders to provide them peace of mind and would appreciate the opportunity to do the same for you.

Contact us online or call 712-226-4000 to receive a thorough consultation with our Omaha trust lawyers today!

Our Commitment:

- Develop long-term relationships with you and your team of financial and planning professionals by earning your confidence and trust.

- Fully understand your circumstances, needs, goals, and concerns while using the most appropriate, efficient, and cost-effective strategies to accomplish your objectives.

- Maintain complete confidentiality.

- Provide the peace of mind that you have hired an estate planning attorney and firm who listens to you and personalizes your plan.

- Remove the pressure of being billed for our time by offering a fixed fee for our services. No surprise billing and additional tools we use also allow you to better understand how your estate plan works and how it meets your goals.

- Make a positive difference in your life.

Navigate the menu on the left of this page to learn more about each practice within Goosmann Law Firm.

Work with our National Network of Estate Planners.

Our Approach

Estate and succession planning can sometimes be complex and Goosmann Law Firm’s approach ensures you receive the most personalized, comprehensive estate and business succession planning strategies in order to meet your personal and business goals as well as preserve your wealth and legacy.

We understand business, the pace of business, and that business decisions also affect the personal lives of business owners. We develop comprehensive estate plans that include business planning and business succession strategies that will also address both your personal and professional goals.

Our team LISTENS. We let you tell us what is important and then we design a plan that meets your wishes. While we certainly engage in sophisticated tax planning, we are sensitive to your values and wishes and will not let that planning overshadow or impede your goals.

We do not have time sheets. Hourly billing causes unpleasant surprises for clients and can mean less communication as they are worried about watching the clock. Goosmann Law Firm offers unique billing options with FIXED FEE options. We meet with you to learn your unique situation and can make recommendations for a plan that makes sense for you. Once a course of action is decided, you will know what you will pay before we begin working. A no-surprise billing approach means you don’t have to worry about the time it takes to ask a question and discuss your plan.

We use SIMPLE AND UNDERSTANDABLE language. We avoid “legalese” and “talking over your head.” We take the time and extra effort to ensure you understand how your personalized estate plan works for you and how it meets your goals.

We’re EFFICIENT. We get to work right away for you. You will not be left waiting to hear from us months after engaging us, uncertain of what progress has been made with your plan to preserve your wealth, your legacy. We stay in communication throughout the process, guiding you through each step. We care about having a short turn-around from meeting with you the first time to presenting you a finalized plan, including Trust Funding.

We ensure your estate plan is complete and THOROUGLY FUNDED. A Trust is no good if your assets are not moved into the Trust. One of the advantages of estate planning is that it avoids the delays and expenses of probate for your property. However, it can do that only if the property is in the Trust. By failing to put your property in the Trust, you will miss out on one of your Trust’s significant advantages. We handle this very important aspect of thorough estate planning for you.

COLLABORATING with your other professional advisors helps ensure your plan is the most comprehensive, effective estate plan. Upon your wishes, we are happy to work in a team approach with your Certified Financial Planner™ practitioners, investment advisors, financial consultants, insurance professionals, Certified Public Accountants, and tax advisors, which will save you time and money.

We have teamed up with WealthCounsel, LLC, the nation’s premier community of estate planning law firms, attorneys and other estate planning professionals. In addition to providing the most comprehensive, sophisticated drafting assistance tool, as a WEALTHCOUNSEL® member, Goosmann Law Firm has access to collective and collaborative wisdom, as well as cutting edge estate planning techniques and education. WealthCounsel also offers a website with a lot of planning information for consumers.

As one of our estate planning clients, you have ON-GOING SUPPORT. Creating your estate plan is not a one-time event. Therefore, you will receive evolving, relevant estate planning information through a monthly newsletter, access to educational events, and a maintenance program that ensures that you have an estate planning team here for your ongoing questions and support when needed. We will make sure that as you have family, business, and financial changes, your estate plan stays up-to-date.

Choosing Goosmann Law Firm for your estate planning needs will provide peace of mind for you, your family, and your business.